Save $800 Per Employee Annually: The WIMPER Tax Savings Playbook

The WIMPER Program helps businesses save up to $800 annually per employee through tax reductions, optimized health plans, and reduced workers' compensation expenses, boosting profitability and employee benefits.

How the WIMPER Program Can Help Your Business Reduce Costs

The WIMPER Program (Wellness Integrated Medical Plan Expense Reimbursement) is a powerful tool for businesses aiming to reduce costs while enhancing employee benefits. This playbook provides a structured approach to achieving tax savings of up to $800 per employee annually through FICA tax reductions, workers' compensation savings, and health plan adjustments. By following these steps, businesses can optimize their payroll taxes and reinvest savings into growth.

Stage 1: Assess Your Current Costs

Understand your baseline expenses to identify potential savings with WIMPER.

Action Steps:

Gather data on your current number of employees, FICA tax contributions, workers' compensation costs, and health plan premiums.

Calculate the total annual cost per employee for these expenses.

Identify areas where WIMPER’s tax codes and reimbursement strategies can reduce costs.

Key Metrics:

Total annual FICA tax paid per employee.

Current workers' compensation premium percentage.

Total health insurance costs per employee.

Stage 2: Implement WIMPER Tax Codes

Leverage IRS-approved tax codes to reduce FICA taxes and workers' compensation costs.

Action Steps:

Integrate WIMPER’s pretax contribution model to reduce taxable income, lowering FICA taxes by up to $800 per employee annually.

Use WIMPER’s reimbursement structure to classify wellness expenses as tax-free, further reducing payroll tax liability.

Adjust workers' compensation policies to reflect WIMPER’s wellness benefits, which can lower premiums by 18-30%.

Key Metrics:

Reduction in FICA tax liability per employee (target: $800 savings).

Decrease in workers' compensation premium percentage (target: 18-30% reduction).

Stage 3: Optimize Health Plan Adjustments

Reduce health plan premiums while maintaining or enhancing employee benefits.

Action Steps:

Transition to a WIMPER-aligned health plan that incorporates wellness reimbursements, reducing overall premium costs.

Offer employees additional benefits (e.g., gym memberships, telehealth) at zero net cost through WIMPER’s reimbursement model.

Monitor employee satisfaction to ensure the new plan meets their needs without increasing costs.

Key Metrics:

Reduction in health plan premium percentage (target: 5-10% decrease).

Employee satisfaction rate with new benefits (target: 90%+ positive feedback).

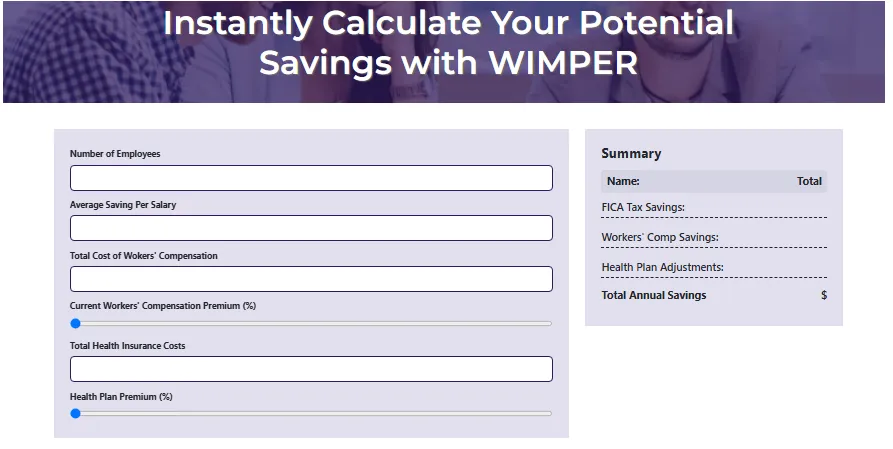

Stage 4: Calculate Your Savings with WIMPER

Use a savings calculator to quantify the financial impact of WIMPER.

Calculator Example : Below is an example calculation for a business with 50 employees, inspired by the provided savings calculator layout:

Number of Employees : 50

Average FICA Tax Savings Per Employee: $800 (WIMPER’s tax code savings)

Total FICA Tax Savings: 50 × $800 = $40,000

Current Workers' Compensation Premium (%): 10%

WIMPER-Reduced Workers' Compensation Premium (%): 7% (30% reduction)

Total Cost of Workers' Compensation (Before WIMPER): $150,000 (assuming $5,000 per employee at 3%)

Total Cost of Workers' Compensation (After WIMPER): $105,000 (at 2.1%)

Workers' Comp Savings: $150,000 - $105,000 = $45,000

Total Health Insurance Costs (Before WIMPER): $300,000 (assuming $6,000 per employee)

Health Plan Premium Reduction (%): 5% o Health Plan Adjustments Savings: $300,000 × 0.05 = $15,000

Total Annual Savings: $40,000 (FICA) + $45,000 (Workers' Comp) + $15,000 (Health Plan) = $100,000

Summary:

FICA Tax Savings: $40,000

Workers' Comp Savings: $45,000

Health Plan Adjustments: $15,000

Total Annual Savings: $100,000

Action Steps:

Use a similar calculator to input your business’s specific numbers.

Share the results with stakeholders to demonstrate WIMPER’s financial impact.

Regularly update calculations as employee numbers or costs change.

Key Metrics:

Total annual savings achieved (target: $800 per employee).

Accuracy of calculator inputs (ensure all costs are up-to-date).

Stage 5: Monitor and Report Savings

Track savings over time and report progress to ensure accountability.

Action Steps:

Set up a monthly report to track FICA tax savings, workers' compensation reductions, and health plan adjustments.

Use WIMPER’s dashboard (if available) to monitor real-time savings data.

Share quarterly savings reports with your team to maintain transparency and motivation.

Graph: Total Annual Savings Over 12 Months

Below is a description of a line graph to visualize the cumulative savings with WIMPER:

Key Metrics:

Cumulative savings achieved by month (target: $100,000 by Month 12 for 50 employees).

Frequency of savings reports (target: monthly).

Stage 6: Reinvest Savings for Growth

Use the savings to fuel business growth and employee satisfaction.

Action Steps:

Reinvest FICA tax savings into marketing campaigns to attract new clients.

Use workers' compensation savings to fund employee training programs, improving retention.

Allocate health plan savings to enhance workplace wellness initiatives, such as on-site fitness programs.

Key Metrics:

ROI from reinvested savings (e.g., increased revenue from marketing).

Employee retention rate post-reinvestment (target: 95%+).

Continuous Improvement

Action Steps:

Solicit feedback from HR and finance teams on WIMPER’s implementation process.

Conduct annual reviews to ensure compliance with IRS tax codes and adjust strategies as needed.

Explore additional WIMPER features (e.g., charitable donations) to further enhance benefits at zero net cost.

Impact

By following this WIMPER Tax Savings Playbook, businesses can:

Save up to $800 per employee annually through FICA tax reductions, workers' compensation savings, and health plan adjustments.

Achieve significant total annual savings (e.g., $100,000 for 50 employees).

Reinvest savings into growth initiatives, enhancing both financial performance and employee satisfaction.

The WIMPER Program transforms payroll taxes into a strategic advantage, delivering measurable savings and long-term value for your business.